Related Articles

To find related articles to this article, click on the relevant links provided by Google at the top of this blog or if available on the right hand side. Enjoy.

Goldcorp Inc (GG)

Current price:33.96

52 week range: 26.15-46.24

Overview

Goldcorp is a Canadian-based mining company with operations in Canada, the United States, Mexico, and Central and South America. In 2008, Goldcorp produced 2.3 million ounces of gold and had around 46 million ounces of gold reserves. The company is developing several large gold mining projects, including the Penasquito mine in Mexico and the Pueblo Viejo mine in the Dominican Republic (morningstar). Notes

Goldcorp feels they are the best positioned senior gold exploration company to capitalize and meet demands for gold. The company expects its flagship Red Lake mine to continue high quality high output for many years to come which should provide Goldcorp with continual cash flow. One thing to note, the company is not well diversified and the stock price could drop if the price of gold begins to fall. Out of the three companies GG has had the most impressive bottom line growth with higher margins. This would lead me to believe the company's cost structure and management is very efficient.

Barrick Gold Corp (ABX)

Current price: 34.82

52 week range: 25.54-48.02

Overview

Barrick Gold is the world's largest gold producer. It has operating mines and development projects on four continents and produced about 8.06 million ounces of gold in 2007 at a cash cost of $350 per ounce.

Notes

Barrick reported a net loss of $5.4 billion or $6.07 per share for their 3rd quarter 2009. The loss was mainly due to a change in accounting procedures as the company eliminates its gold hedges. They intend to fully leverage gold prices to give investors a higher return with increases in gold prices. If the upward trend of gold prices slows or reverses this could leave Barrick in deep water. But if gold prices continue to climb, Barrick will be better positioned for growth.

Freeport-McMoRan Copper & Gold (FCX)

Current price: 66.69

52 week range: 24.22-90.55

Overview

Freeport is the world's largest publicly traded copper mining company. They also mine for gold and molybdenum. Freeport takes pride in its geographic location diversification and has a more diversified line of products than other tradition gold mining companies. If your looking to get into gold as an investment and want some diversification this company fits that description. If you are looking for strictly gold companies chose one of the above.

Notes

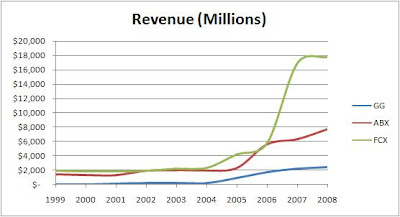

FCX has been very profitable for the past 10 years with strong revenue growth. This is due to the rising prices of gold and copper. The company did have good will right offs and mark downs of inventories for the 4th quarter of 2008 due to an acquisition. But with that aside the company has been very profitable.

Comparison of the three

Follow Us on Twitter twitter.com/stocklook

Nice. I've been watching GG and looking for a good in.

ReplyDeleteWhat a helpful post really will be coming back to this time and time again. Thanks...

ReplyDeletePenny Stocks